Credit union performance worsened sharply in March compared with other lenders for automobile loans and credit cards, but was better for first mortgages, based on new data from the Fed and CUNA.

Comparing CUNA data to data released Friday from the Fed’s G-19 Consumer Credit Report showed credit unions lost market share for both types of consumer lending.

The setbacks occurred as credit unions set new records for slow loan growth in March as first mortgage growth fell into the single digits and automotive lending stalled, according to CUNA data released Thursday.

CUNA’s Credit Union Monthly Estimates showed the total loan portfolio balance stood at $1.2 trillion as of March 31, up 4.9% from a year earlier. It was the slowest 12-month gain in more than six years.

Credit card balances have been falling at banks and credit unions since COVID-19 was declared a pandemic in March 2020. Until this month, credit unions had been seeing milder 12-month drops, allowing them to pick up market share. This month the leads changed, with balances falling 10.3% to $58.3 billion at credit unions and falling 9.6% to $831 billion at banks.

Overall automotive loans grew only 0.4% at credit unions, but grew 6.1% at other lenders.

At credit unions, new car loans fell 6.5% to $137.9 billion—the lowest portfolio value since March 2018. Used car loans rose 4.9% to $244.6 billion. The pace of used car portfolio growth has been generally trending up over the past year from a 12-month rate of 4.1% in March 2020.

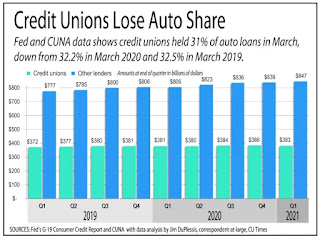

Market share for credit unions was 31% in March, down from 32.2% in March 2020, 31.5% in December 2020 and its all-time peak of 32.6% in December 2018.

Some of the share has been gained by captive lenders offering zero-percent financing in the new car market. But the gains have been persistent, and the trend is lengthening.

Other lenders have increased their portfolios at a faster rate than credit unions every quarter since June 2019. From December to March, portfolios grew 0.3% at credit unions and 0.6% at other lenders.

The credit union stall is happening as the car market is constrained more by supply than demand. Dealers sold 3.8 million new cars in the first quarter, which was 8.7% better than 2020′s first quarter and 4.9% worse than the first quarter of 2019, according to Cox Automotive.

The Irvine, Calif., data analytics company forecasts used car sales this year to be 2% better than 2019. Dealers sold 6% fewer cars from 2019 to 2020, and are expected to sell 9% more from 2020 to 2021.

CUNA estimates first mortgages grew 9% to $530 billion. It was the lowest growth rate since the 6.9% growth rate for the 12 months ending February 2020. Growth had exceeded 10% in every month since then.

However, credit unions outperformed banks and other lenders. The Mortgage Bankers Association estimates that first mortgage portfolios stood at $11.3 trillion among all lenders as of March 31, 4.8% higher than a year earlier.

Credit union second-lien mortgages fell 10.7% to $82.7 billion. A year earlier, from March 2019 to March 2020, they rose 2.6%.

The CUNA report estimated the nation’s 5,259 credit unions had 127.7 million members in March, a 3.2% gain from March 2020, compared with 3.4% growth a year earlier. The report also showed these estimates for March and 12-month changes:

- Fixed-rate first mortgages rose 13.1% to $410.1 billion as of March 31.

- Adjustable-rate first mortgages fell 2.9% to $119.9 billion.

- Second mortgages fell 16.1% to $28.8 billion.

- Home equity lines of credit fell 7.5% to $54 billion.

- Assets grew 19.4% to $1.99 trillion. A year earlier, from March 2019 to March 2020, it rose 8.7%.

- Savings grew 23.8% to $1.73 trillion. A year earlier, it rose 8%.

- Capital grew 6.4% to $195.3 billion. A year earlier, it rose 10.1%.

- Members grew 3.2% to 127.7 million. A year earlier, it rose 3.4%.

- Loans per member grew 1.7% to $9,390. A year earlier, it rose 3.4%.

- Savings per member grew 20% to $13,565. A year earlier, it rose 4.4%.

0 comments:

Post a Comment